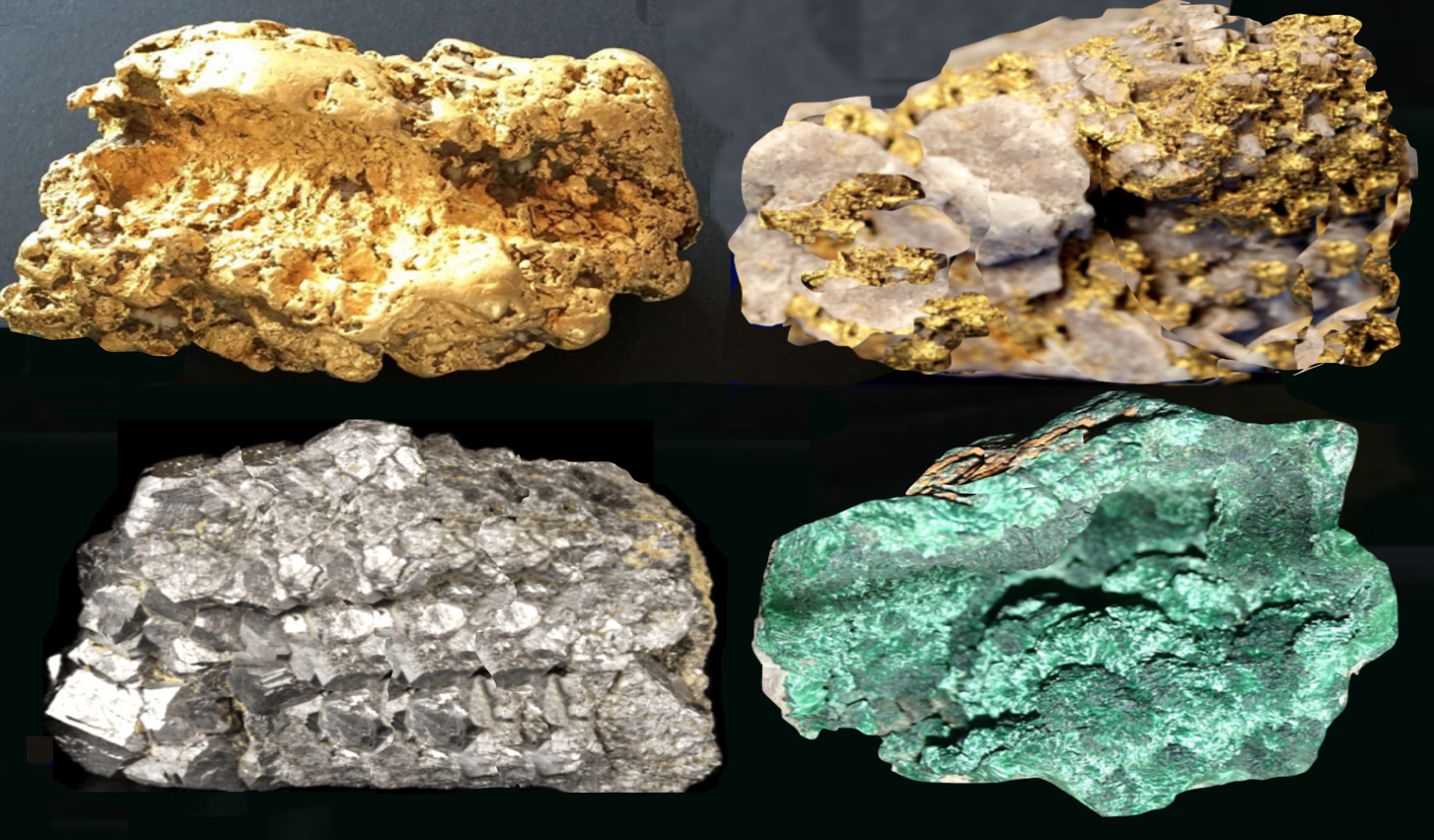

Buying precious metals can be an important expansion to your venture portfolio. These metals, including gold, silver, platinum, and palladium, have been loved for quite a long time for their unique case and inherent worth. For beginners, Precious Metals understanding how to explore this market is urgent for going with educated and beneficial choices.

Grasping the Sorts of Precious Metals

- Gold: Frequently seen as a fence against expansion and financial insecurity, gold is the most famous precious metal venture. It is accessible in different structures, including coins, bars, and gems. Gold’s worth is affected by worldwide financial circumstances and its utilization in gadgets and gems.

- Silver: Silver is more reasonable than gold and is utilized in different modern applications, including gadgets and sunlight powered chargers. Putting resources into silver can be a decent choice for those hoping to expand their portfolio without committing a lot of capital.

- Platinum: Known for its modern purposes and extraordinariness, platinum can offer extraordinary speculation valuable open doors. It is utilized in exhaust systems and gems, and its cost can be more unpredictable than gold or silver.

- Palladium: Like platinum, palladium is utilized in modern applications, especially in automotive impetuses. It has acquired consideration as of late because of its huge cost increments and developing interest.

Instructions to Purchase Precious Metals

- Settle on the Structure: Precious metals can be bought in different structures, including bullion coins, bars, and adornments. Coins and bars are normally the most famous structures for investors. Each structure has its own arrangement of benefits and liquidity contemplations.

- Pick a Legitimate Seller: Guarantee you purchase from a respectable vendor. Search for sellers with a solid history and positive customer surveys. Check in the event that they are licensed by industry associations like the Numismatic Certification Company (NGC) or the Expert Coin Evaluating Administration (PCGS).

- Grasp Valuing: Precious metal costs vary in light of economic situations. Look into the ongoing spot costs and comprehend that sellers will charge a top notch over the spot cost for their items.

- Really look at Immaculateness and Authenticity: Check the virtue and authenticity of the metal you are buying. For instance, gold bullion ought to have a base immaculateness of 99.5%, and trustworthy items will be stepped with certificate marks.

Storage and Security

Legitimate storage is fundamental to safeguard your venture. Consider utilizing a protected store box at a bank or a solid home safe. A few investors likewise settle on proficient vault storage presented by precious metal vendors.

Putting resources into Precious Metals can be a shrewd monetary choice whenever finished with cautious thought. By figuring out the sorts of metals, picking a legitimate vendor, and guaranteeing legitimate storage, you can settle on informed choices that line up with your monetary objectives. With this guide, you’re well headed to turning into a proficient investor in precious metals.